Offshore Trust Setup Costs and Fees: What to Expect

Offshore Trust Setup Costs and Fees: What to Expect

Blog Article

The Function of an Offshore Rely On Effective Estate Planning Techniques

Offshore trust funds are significantly acknowledged as an essential element of effective estate planning approaches. They provide one-of-a-kind benefits such as asset defense, tax benefits, and boosted privacy. By dividing ownership from control, individuals can safeguard their wealth from legal difficulties and potential creditors. However, the complexities bordering offshore trust funds can elevate inquiries about their implementation and efficiency. Discovering these intricacies discloses understandings that can meaningfully impact one's monetary heritage

Understanding Offshore Trusts: A Detailed Overview

Offshore counts on work as tactical financial instruments in estate preparation, designed to safeguard properties and offer tax obligation benefits. These counts on are established in jurisdictions outside the settlor's home nation, usually featuring favorable legal frameworks. Generally, individuals use offshore depend guard wide range from political instability, economic recessions, or possible lawsuits.The core structure of an overseas trust fund entails a settlor, who develops the trust; a trustee, in charge of managing the possessions; and beneficiaries, who benefit from the depend on's assets. This splitting up of ownership and control can boost possession security, making it extra challenging for creditors to assert those assets.Additionally, overseas counts on can promote estate preparation by guaranteeing a smooth transfer of wide range across generations. They provide versatility pertaining to property management and circulation, allowing the settlor to customize the depend on according to individual desires and household demands. This customization is important for lasting economic safety and security and household tradition.

The Tax Obligation Benefits of Offshore Trusts

Offshore trusts provide considerable tax obligation benefits, largely through tax deferral advantages that can improve riches conservation. By strategically placing possessions in jurisdictions with positive tax regulations, people can effectively secure their wide range from higher tax (Offshore Trust). In addition, these trust funds function as a durable possession security method, safeguarding properties from lenders and legal insurance claims while optimizing tax obligation performance

Tax Obligation Deferral Conveniences

Frequently overlooked, the tax obligation deferral benefits of trust funds established in foreign territories can play a critical role in estate planning. These trust funds typically allow people to delay taxes on revenue created by the depend on possessions, which can result in substantial rises in riches accumulation with time. By holding off tax liabilities, clients can reinvest earnings, boosting their overall financial growth. In addition, the specific tax regulations of numerous overseas jurisdictions might supply opportunities for further tax obligation optimization. This strategic advantage allows individuals to align their estate preparing objectives with lasting economic goals. Ultimately, understanding and leveraging the tax obligation deferral advantages of offshore counts on can greatly enhance the effectiveness of an estate strategy, ensuring that wide range is preserved and optimized for future generations.

Property Defense Strategies

Tax benefits are simply one facet of the benefits that offshore trust funds can offer in estate planning. These trusts work as durable property security approaches, protecting assets from lawful cases and potential lenders. By moving properties right into an overseas trust fund, people can produce an obstacle that makes complex lenders' access to those possessions. This is specifically beneficial in jurisdictions with desirable trust laws, providing an extra layer of protection. In addition, overseas depends on can secure wide range versus unanticipated scenarios, such as claims or divorce settlements. They likewise make it possible for people to keep control over their properties while guaranteeing they are protected from external risks. Eventually, the tactical use of offshore trust funds can improve both economic safety and estate planning efficacy.

Property Protection: Protecting Your Wealth

Privacy and Confidentiality in Finance

In the domain name of estate planning, keeping privacy and privacy is a substantial concern for several individuals. Offshore trust funds work as an effective tool to attain these goals, as they can effectively protect economic events from public examination. By putting properties in an offshore count on, people can decrease the risk of undesirable direct exposure to their wealth and financial strategies.The intrinsic features of overseas trusts, such as strict privacy legislations and guidelines in particular territories, boost confidentiality. This implies that details relating to the trust fund's possessions and recipients are typically shut out of public records, protecting delicate information.Moreover, the usage of an offshore count on can assist reduce risks associated with potential legal disagreements or financial institution insurance claims, further promoting economic personal privacy. Generally, the calculated application of overseas trust funds can considerably boost a person's economic discretion, enabling them to handle their estate in a very discreet fashion.

Selecting the Right Jurisdiction for Your Offshore Trust fund

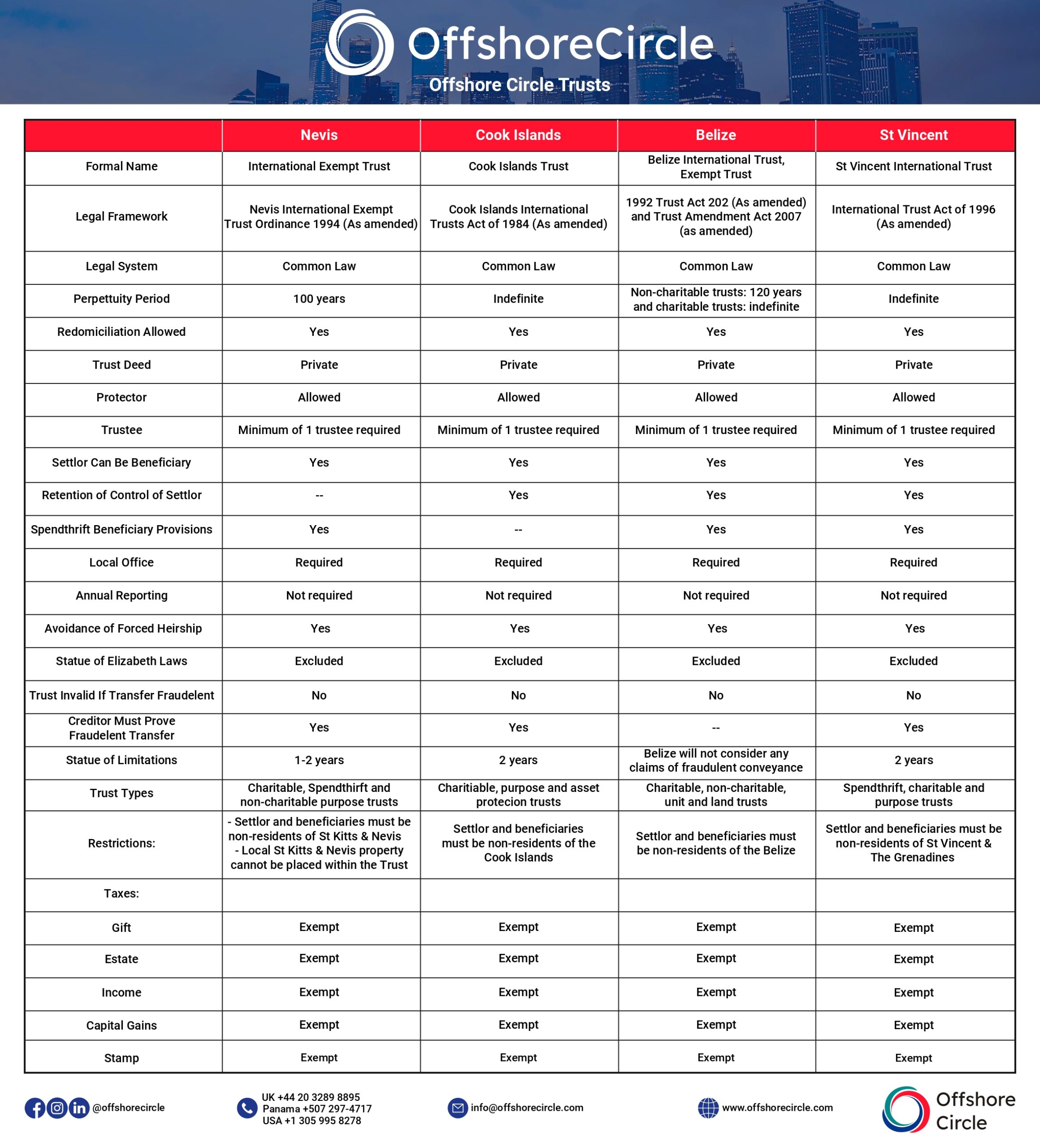

When considering the suitable territory for an overseas count on, what aspects should be prioritized? Most importantly, the legal framework of the territory is vital. This includes the trust regulations, possession defense laws, and the total security of the lawful system. A jurisdiction with well-defined regulations can offer improved protection and enforceability of the trust.Another important consideration is tax obligation effects. Jurisdictions vary significantly in their tax obligation treatment of overseas counts on, which can impact the overall efficiency of the estate preparation technique. In addition, a beneficial regulative environment that advertises personal privacy and confidentiality need to be evaluated, as this is typically an essential inspiration for developing an offshore trust.Finally, availability and management requirements are crucial. Jurisdictions with professional services and effective procedures can facilitate easier administration of the count on, ensuring that it fulfills the grantor's goals and follows conformity demands.

Typical Misunderstandings About Offshore Trusts

What are the widespread misunderstandings bordering overseas trusts? Several individuals mistakenly think that overseas trust funds are exclusively for the ultra-wealthy, thinking they are solely devices for tax evasion. Actually, offshore counts on can offer a diverse series of estate planning needs, benefiting individuals of different monetary histories. One more typical misconception is that these trusts are unlawful or dishonest; nonetheless, when established and taken care of properly, they abide by international laws and regulations. In addition, some individuals are afraid that offshore counts on lack defense from financial institutions, however specific jurisdictions provide robust lawful safeguards. There is likewise an idea that taking care of an overseas trust fund is expensive and prohibitively intricate, which can prevent potential customers. In reality, with appropriate assistance, establishing and keeping an offshore depend on can be much more uncomplicated than anticipated. Attending to these misunderstandings is vital for people taking into consideration offshore depends on as component of their estate preparation approach.

Actions to Developing an Offshore Trust Fund for Estate Preparation

Establishing an overseas trust for estate preparation involves several crucial actions. People must pick an ideal territory that lines up with their legal and monetary objectives. Next, choosing the right count on properties and drafting an in-depth trust file are vital to ensure the trust fund operates efficiently.

Picking the Territory

Choosing the appropriate jurisdiction for an overseas trust is vital, as it can significantly impact the depend on's effectiveness and the protections it provides. Aspects such as political security, lawful framework, and tax obligation guidelines should be carefully assessed. Jurisdictions known for strong possession security legislations, like the Cook Islands or Nevis, are usually preferred. Furthermore, the ease of developing and maintaining the trust fund is important; some regions offer structured processes and fewer administrative obstacles. Ease of access to local legal know-how can likewise impact the choice. Ultimately, the chosen territory needs to line up with the grantor's certain goals, guaranteeing maximum benefits while lessening threats connected with governing modifications or jurisdictional restrictions.

Picking Count On Assets

Picking the proper assets to position in an overseas count on is a vital step in the estate preparation process. Individuals have to very carefully assess their properties, including cash, financial investments, genuine estate, and business passions, to figure out which are suitable for incorporation. This examination should take into consideration aspects such as liquidity, potential growth, and tax effects. Diversity of properties can boost the trust's stability and guarantee it fulfills the beneficiaries' needs. Additionally, it is necessary to represent any you could look here type of legal restrictions or tax obligation responsibilities that may occur from transferring specific properties to the overseas trust. Eventually, a well-balanced selection of count on possessions can significantly affect the efficiency of the estate plan and protect the client's want asset distribution.

Drafting the Count On Paper

Drafting the count on file is an essential action in the creation of an overseas depend on for estate planning. This paper details the particular terms under which the trust operates, describing the duties of the trustee, recipients, and the circulation of assets. It is very important to plainly define the function of the depend on and any type of specifications you can check here that might apply. Lawful requirements might differ by territory, so seeking advice from a lawyer experienced in offshore counts on is crucial. The record ought to likewise resolve tax effects and property security techniques. Effectively executed, it not just safeguards possessions however additionally assures compliance with international regulations, inevitably facilitating smoother estate transfers and lessening possible disagreements among beneficiaries.

Regularly Asked Concerns

Exactly How Do Offshore Trusts Affect Probate Processes in My Home Country?

Offshore depends on can greatly influence probate procedures by possibly bypassing regional jurisdictional regulations. They might safeguard assets from probate, minimize tax obligations, and improve the transfer of wide range, inevitably resulting in a more effective estate negotiation.

Can I Be a Beneficiary of My Own Offshore Count on?

The question of whether one can be a recipient of their own overseas depend on frequently develops. Generally, individuals can be named beneficiaries, however particular guidelines and effects might vary depending upon territory and depend on structure.

What Occurs if I Move to One More Country After Developing an Offshore Depend On?

If a private steps to one more country after developing an overseas depend on, they may deal with varying tax obligation ramifications and legal laws, possibly affecting the trust fund's monitoring, distributions, and reporting obligations according to the brand-new jurisdiction's regulations.

Are Offshore Counts On Ideal for Little Estates?

Offshore trusts could not appropriate for tiny estates due to high arrangement and maintenance prices. They are normally more helpful for bigger possessions, where tax benefits and possession defense can justify the expenditures included.

What Are the Prices Connected With Maintaining an Offshore Count On?

The costs connected with maintaining an offshore trust normally consist of legal charges, administrative expenses, tax obligation conformity, and possible trustee costs. These prices can vary substantially based upon the complexity and jurisdiction of the trust fund. Usually, people use offshore counts on to guard wide range from political instability, financial slumps, or prospective lawsuits.The core structure of an offshore depend on involves a settlor, that develops the trust; a trustee, accountable for taking care of the properties; and recipients, that benefit from the trust's possessions. By putting wide range within an overseas depend on, individuals can safeguard their possessions versus suits, divorce negotiations, and various other unforeseen liabilities.Offshore trusts are commonly controlled by the regulations of territories with desirable possession protection guidelines, offering enhanced protection compared to residential choices. By putting properties in an overseas trust fund, people can minimize the threat of unwanted exposure to their wealth and financial strategies.The fundamental functions of overseas trusts, such as stringent personal privacy legislations Look At This and policies in certain jurisdictions, improve discretion. Selecting the right jurisdiction for an overseas trust is necessary, as it can substantially influence the trust's performance and the defenses it supplies. Composing the trust fund file is a crucial step in the development of an offshore trust for estate preparation.

Report this page